PARAMOUR JOKER EA

The PARAMOUR JOKER EA combines key techniques for creating reversal levels. This makes it easy to integrate into your trading system. Support and resistance levels are among the most used technical analysis tools. Their popularity stems from their precision in identifying pivot points for trend reversals.

The PARAMOUR JOKER EA automatically marks these levels on the MT4 terminal chart. Price movement can change direction when interacting with these levels, offering trade opportunities with profit potential. Moreover, breakouts above or below the levels offer great trading opportunities.

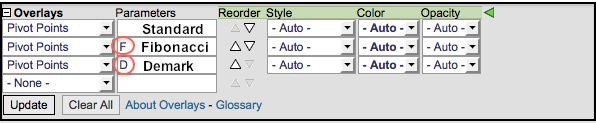

Notably, this EA uniquely blends Standard, Fibonacci, Tom DeMark, Camarilla and Woodie methods for constructing reversal levels.

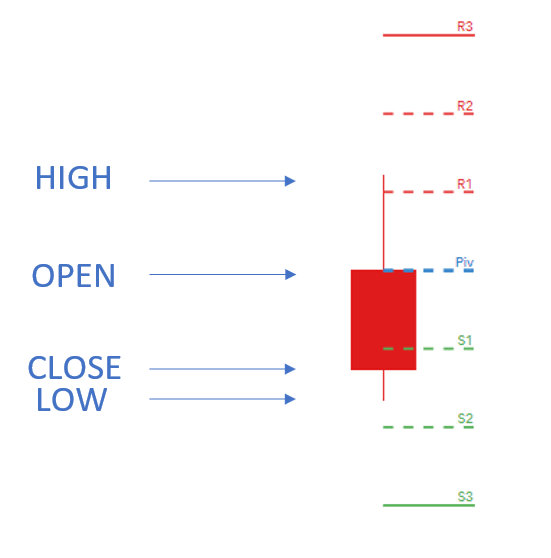

The EA determines and plots possible reversal areas on the charts. Blue lines indicate pivot points, green lines indicate support levels, and red lines show resistance levels.

It helps determine ideal areas to place stop loss and take profit.

PARAMOUR JOKER EA BASED ON PIVOT POINTS

PARAMOUR JOKER EA with the help of pivot point is a technical analysis EA, or calculations, used to determine the overall trend of the market over different time frames. The pivot point itself is simply the average of the intraday high and low, and the closing price from the previous trading day. On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

The pivot point is the basis for the PARAMOUR JOKER EA, but it also includes other support and resistance levels that are projected based on the pivot point calculation. All these levels help traders see where the price could experience support or resistance. Similarly, if the price moves through these levels, it lets the trader know the price is trending in that direction.

The PARAMOUR JOKER EA with the help of pivot point is an intraday EA for trading futures, commodities, and stocks. Unlike moving averages or oscillators, they are static and remain at the same prices throughout the day. This means traders can use the levels to help plan out their trading in advance.

For example, EA know that if the price falls below the pivot point, it will likely be shorting early in the session. Conversely, if the price is above the pivot point, they will be buying. S1, S2, R1, and R2 can be used as target prices for such trades, as well as stop-loss levels.

Combining pivot points with other capabilities is the one of robot advantage. In this EA, pivot point that also overlaps or converges with a 50-period or 200-period moving average (MA), or Fibonacci extension level, becomes a stronger support/resistance level.

Types of pivot points :

There are different types of pivot point can be used in PARAMOUR JOKER EA. They include:

- Standard pivot points;

- Woodie pivot points;

- Camarilla pivot points;

- Fibonacci pivot points; and

- Tom DeMark’s pivot points.

How to trade PARAMOUR JOKER EA?

- PARAMOUR JOKER EA, developed by PARAMOUR FOREX TRADER team, is a well-known smart forex robot with expansive capabilities. It has garnered attention in multiple sectors for its pivot points calculation abilities, information processing, and more. Its integration with pivot points, suggests that users can get a forecast from the EA, potentially giving traders an edge in predicting market movements.

- However, there’s a cautionary note to consider here. While PARAMOUR JOKER EA is incredibly powerful, its main strength lies in understanding and generating human-like trading. Using it for market prediction would require extensive and specialized training on financial data. Additionally, Pivot Point, while being a recognized name, would similarly need specialized training for precise market forecasting.

- Identifying the zones for setting stop loss and take profit orders during day trading. Using the previous day’s chart data to determine the points of significant price movements can help you make good trades, especially when you combine pivot points with other technical analysis indicators.

- You can calculate and use pivot points for any chart, be it over 15 minutes to even a week. If you prefer to swing trade, use a previous week’s chart data to make pivot points for the current or upcoming week.

- Pivot points help you identify the direction a market is moving – bullish if the pivot point price gets broken in uptrend or bearish if the price drops through the pivot point price – so you can make strategic decisions accordingly.

- Traders use pivot points to set limit orders for entering or exiting a market. Depending on your strategy, you may decide to buy an asset when it breaks through a resistance level or sell when it drops to a support level.

Recommendations for PARAMOUR JOKER EA

- Minimum account balance of 100$.

- Work Best on EURUSD, GBPUSD,AUDUSD and NZDUSD. (Work on any currency pair)

- Run on H1 TimeFrames (Same result on any timeframe

- To use our EA, first set it to the DAILY timeframe to gather data. Once you see over 30 candlesticks, switch back to the H1 timeframe.

- This EA should work on VPS continuously to reach stable results.

- The EA is NOT sensitive to spread and slippage. But We advise using a good ECN broker

.